After several years of rapid expansion and increasing demand in markets worldwide, the coworking industry — like all industries — faced a range of unprecedented consequences in 2021 as a result of the COVID-19 pandemic.

From navigating the effects of government-mandated closures to dwindling occupancy rates, coworking spaces were pressured to reevaluate their operations and come up with new business models, sanitation protocols, and flexible solutions for their members as quickly as possible.

The end of the year has shown a range of positive signs for coworking’s future as hybrid work becomes a mainstay. Slowly but surely, coworking spaces are welcoming members back into their workspaces, but not without making permanent changes to the way their spaces operate.

Moreover, emerging trends such as large corporations adopting permanent remote work strategies and enterprises looking to decentralize their teams have sparked new demand. As remote work becomes a staple of “the new normal” on a global scale, coworking operators actually stand to benefit, with experts predicting flexible workspace will account for 30% of all office real estate by 2030.

2021: Our Perspective

At Coworker, we have witnessed the gradual recovery of the coworking industry in terms of interest and supply this year.

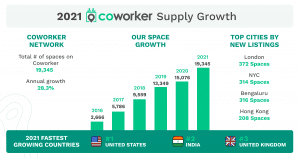

Coworker ended 2021 with 19,345 total coworking spaces across 172 countries and over 3,000 cities. This represents an increase of 4,269 new spaces (+28.3%), up from 15,076 in December 2020 and 13,384 in December 2019.

Approaching the milestone of 20,000 coworking space listings this year provided a welcome beacon of hope amidst the many uncertainties in the industry.

With continued lockdowns, we anticipated that our number of new space listings would decrease in 2021, especially when compared to the 40% growth that we experienced in 2019. Still, last year, witnessing a 28.3% growth in our overall network is indicative that recovery from COVID-19 is underway.

Additional data we’ve collected throughout the year has generated the following insights.

Coworking Supply Growth – Top Continents

Since our founding in 2015, Coworker has experienced rapid expansion as the coworking industry has matured and developed. Our database now includes listings for coworking spaces on every continent in 172 countries all over the world.

Broken down by continent, here is the ranking of the top continents with the most new spaces listed on Coworker in 2021:

- Europe — +1,551 spaces

- Asia — +993 spaces

- North America — +1,376 spaces

- South America — +154 spaces

- Oceania — +150 spaces

- Africa — +238 spaces

- Central America — +24 spaces

Coworking Supply Growth – Top Countries

In 2021, approximately 150 new coworking spaces were submitted to be listed on Coworker each month. This monthly growth accounted for 19,345 total coworking spaces at year’s end of the spaces that were approved.

Of these new spaces added to Coworker in 2021, the top three countries that accounted for the largest amount of spaces (thereby signaling some of the fastest-growing countries for coworking) include:

#1 USA

Total at the end of 2020: 2,757

Total now: 3,818

Annual change: +38.5%

#2 India

Total at the end of 2020: 1,628

Total now: 1,789

Annual change: +9.9%

#3 United Kingdom

Total at the end of 2020: 746

Total now: 1,097

Annual change: +47.1%

Coworking Supply Growth – Top Cities

Also in 2021, the total number of cities with listings on Coworker reached 3,036.

Even in the lowest-traffic months for coworking inquiries during the pandemic, Coworker saw 107 new city additions between April and September of 2020. (This means that these cities were added to our database for the very first time, including Ratingen, Germany; Solna, Sweden; and Salvador, Brazil to name a few.)

In 2021 alone, there were 619 new city markets added to Coworker, signaling not only healthy expansion among our network but also recovery from the negative impacts of the pandemic that occurred in 2020.

While the largest number of spaces in our network encompass the leading urban markets such as Bengaluru, London, Hong Kong, and New York City, seeing this type of growth in small, often suburban cities shows that the coworking industry is continuing to enter new markets.

Of these new spaces added to Coworker in 2021, the cities with the most amount of individual coworking listings include:

–Bengaluru – 290 spaces

–London – 281 spaces

–New York City – 263 spaces

–Hong Kong – 185 spaces

2021 In Review

The global pandemic has made both 2020 and 2021 challenging years for coworking. Despite the many unforeseen challenges this past year, we believe flexible offices will play a crucial role in the new hybrid style of working.

Based on recent metrics, we predict global demand will climb another 40-50% from where it is today by as early as Q2 of 2022.

Looking to the new year, the coworking industry will see a range of new trends take root, including more corporates turning to coworking spaces for their decentralized operations and virtual offices taking precedence.

Furthermore, the rise of the hub-and-spoke model of working will give rise to new demand for flexible, multi-space memberships — such as Coworker’s Global Pass for individuals and teams.